Murphy Conclusively Demonstrates...

that debt is a red herring here.

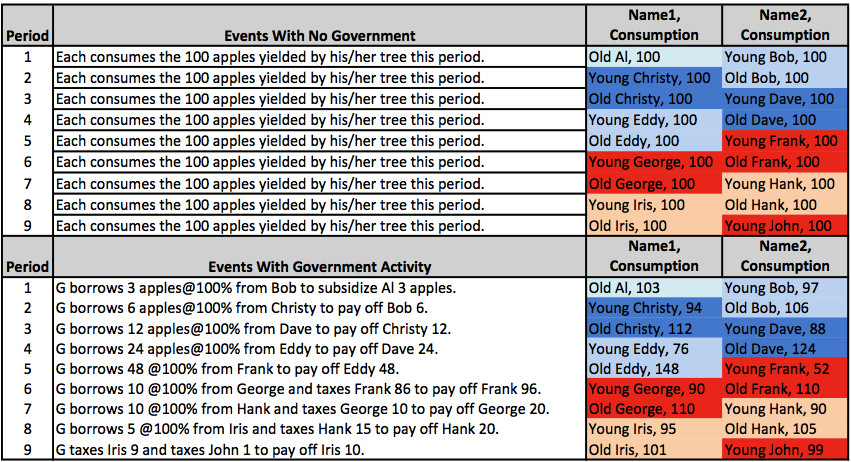

How so? Just go through his table:

Every time he wrote "borrows," replace it with taxation, and replace "pay off" with "transfers to."

The entire consumption pattern will be unchanged.

It ain't the debt, it's the inter-generational transfers.

UPDATE: The key to what makes Bob's model work the way he wants it is not the interest on the debt. At any point in time, for every dollar spent paying that interest, a dollar is received by someone who holds the debt. They key to Bob's model is that it is always the young who are being deprived of consumption to give the old more consumption. And it is very much key that they are alive at the same time so that this can be done! Of course, if you keep doing that, it will also be true that the young 100 years from now will be worse off.

How so? Just go through his table:

Every time he wrote "borrows," replace it with taxation, and replace "pay off" with "transfers to."

The entire consumption pattern will be unchanged.

It ain't the debt, it's the inter-generational transfers.

UPDATE: The key to what makes Bob's model work the way he wants it is not the interest on the debt. At any point in time, for every dollar spent paying that interest, a dollar is received by someone who holds the debt. They key to Bob's model is that it is always the young who are being deprived of consumption to give the old more consumption. And it is very much key that they are alive at the same time so that this can be done! Of course, if you keep doing that, it will also be true that the young 100 years from now will be worse off.

OK, but my concern with that is that if you just have contemporaneous tax financed intergenerational transfers (like how we do Social Security in the U.S.), you're not going to increase the size of that transfer every period in real terms.

ReplyDeleteThat's what happens in Bob's model. That's the result of interest (which is only relevant when talking about debt), and that does make future cohorts poorer than current cohorts.

And if you just have a tax financed system that doesn't have to worry about interest, you don't get that. That is generated by debt financing.

Yes, but others are *receiving* those interest payments. If we have the young receive the payments and the old make them, we can have debt being a burden on the present generation.

DeleteIf you do what you suggest you just get a random set of taxation-funded transfers that cause different generations to have different levels of utility

ReplyDeleteIn Bob's model each successive stage is driven by the need to pay off the debt created in the previous stage. Within the constraints of his assumption this does indeed show how the burden of debt can be moved forward in time.

OK, rob, that's true. But as I noted, we can have the older cohort paying of the debt and the younger one getting the consumption, if we want.

DeleteRob, I thought about your point for a while. No, the interest is not the key to the model: see my update above.

Delete"If you do what you suggest you just get a random set of taxation-funded transfers that cause different generations to have different levels of utility"

Right. And this is what Bob's model is as well. The debt is a red herring.

I think I'm missing your point.

DeleteBobs model indeed wants to xfer from the young to the old. If it did this via taxation alone then the model could be sustained for ever. With Bobs utility function everyone would be worse off as a result.

If one used debt but with a 0 IR then likewise the xfers would be sustainable.

It's only when you have a positive IR that the levels of xfers need to increase generation by generation and end up being unsustainable. It's actually the older generation that gets stiffed when taxations is used because inter generation xfers are no longer practical.

So Bobs model has an internal logic that the same sets of xfers done just by taxation does not have.

"It's only when you have a positive IR that the levels of xfers need to increase generation by generation and end up being unsustainable."

DeleteThat is incorrect, rob. There is nothing about increasing debt payments coming due that requires inter-generational transfers at all. That is something entirely arbitrary that Bob has put in the model ad hoc.

The payments needed to service the debt keep going up. But, at every point in time, for every dollar taken from Y to service the debt, a dollar goes to X who is a bond holder. There simply is no reason that Y can't be an old person and X a young person: then, Bob's model would reach the exact opposite conclusion.

See my new post on trenchcoats.

OK I've got it.

ReplyDeleteIf those alive in period 0 set themselves the task of enriching themselves at the expense of a future generation they would conclude that they need to transfer apples to the elders in period 1, followed by a compensating transfer in period 2 to the youngers from period 1 (now the elders from period 2).

If they do this then they have achieved their goal and someone in the future will now lose out and it does not matter if they use tax or bonds to do the transfers.

You are right: its the transfers not the bonds that does the damage.

I think I have a more serious critique of Bob's OLG model.

ReplyDeleteHis model assumes that the endowment is initially distributed equally between all individuals in all period with a utility function where an equal distribution between period maximizes utility.

This means that any transfer no matter how small, no matter whether private or public, via tax, gift or loan will lead to a loss of utility by someone at some point in the model . (Bob's model shows how clever use of transfers can push this loss further down the generations).

However if one changes either of the assumptions so that the endowment is not distributed equally between periods or peoples utility function favors consumption in one period over the other then things change. In these cases some transfers will actually lead to some individuals gaining utility with no matching loss in utility by anyone else. (take the case where the endowment is 150 to young, and 50 to the old with the same utility function. Here transfers from young to old would increase all individual's lifetime utility).

So: One can have OLG models that show transfers are "good" and OLG models that show transfers are "bad". Whether the real world more closely matches Bob's OLG model (where all transfers are "bad") or one of the many OLG models where some transfers are "good" is an empirical issue. But I am sure that Krugman supporters will not be too worried about the outcome of such empirical research.